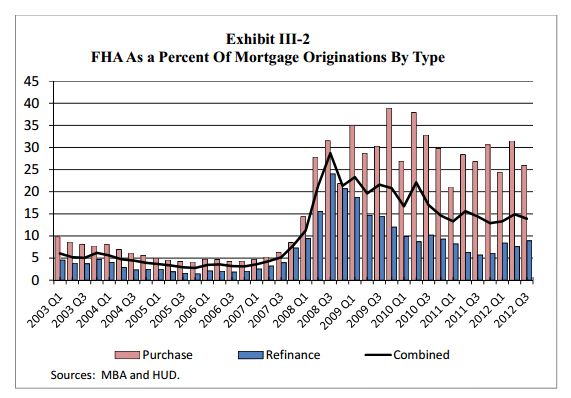

The assumption that households are doing much better simply because the stock market is up is really a problematic understanding of how wealth is dispersed across the United States. I vividly remember a handful of parties back during the peak of the bubble where people would often quote how much their net worth went up courtesy of the housing bubble. ?My home that I bought in the 1990s is now worth over $1 million.? As all of you know, until you sell the home those gains are largely on paper and many did not sell. In fact, many tapped out large portions of that equity and spent it. This is why even with home prices moderately recovering US households still have close to record low equity in their homes. It probably does not help that low down payment FHA insured loans are such a large part of the market encouraging Americans to make the biggest purchase of their lives with very little down. The Fed reported last week on net worth figures and it is worth digging deep into the data.

Home is where the net worth is for most Americans

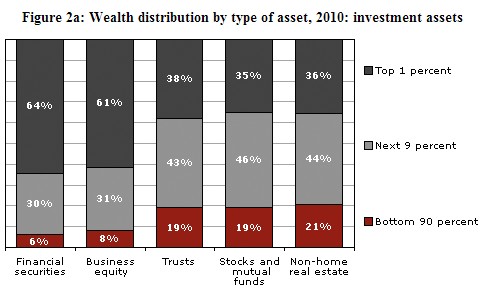

The strong rally in the stock market has done very little to improve the balance sheet of most Americans. Why? Because most do not own significant levels of stocks or mutual funds:

The bottom 90 percent of Americans own 6 percent of all financial securities. This same group only owns 19 percent of all stock mutual funds. To the point, the median family?s portfolio is worth well under $50,000. Keep in mind the stock market is down 10 percent from the previous peak. Does going from $50,000 to say $45,000 really change the dynamics of your typical American family? Probably not. But think of someone that bought at the peak with a FHA insured loan. Let us assume they paid $250,000 and went in with 3.5 percent down which is the most common down payment for these loans:

Home price: $250,000

Down payment: $8,750

Current home price: $175,000

Underwater: -$75,000

To reach the initial sale price, home prices would need to rise over 42 percent.

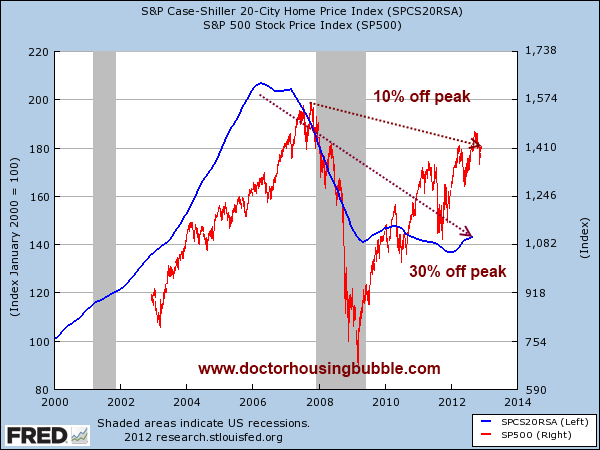

Welcome to the wonderful world of debt leverage. That massive stock rally has done very little for the typical household portfolio. Yet the now 30 percent decline in real estate values has blasted a hole in their net worth. Where are we getting the above numbers from? Right from the market:

While the stock market is only off by 10 percent from the peaks reached in 2007, housing is still down by 30 percent. This is why the good news in the Fed report needs to be looked at more carefully:

Q3 2012 household net worth: $64.8 trillion

Q3 2007 (peak) household net worth: $67.3 trillion

So overall, household net worth is down $2.5 trillion from the peak (3.7%)

Real estate values however are still significantly down (main net worth item for most families):

Q3 2012 household real estate values: $17.2 trillion

Peak was at $22.7 trillion (according to the Fed, real estate values are down 24 percent from the peak versus the Case Shiller which shows a 30 percent fall from the peak). This is why this recovery still feels very much like a recession to the vast majority of Americans.

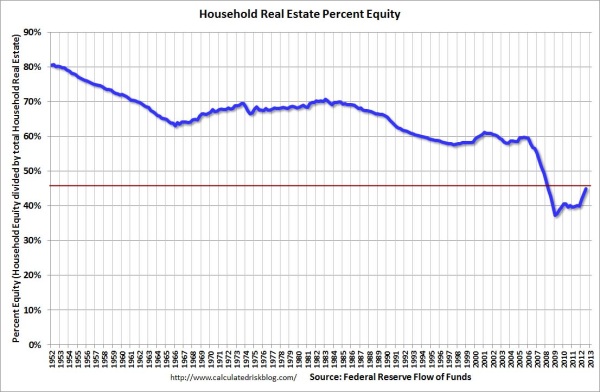

Even though housing values have gone up in 2012 (largely due to low interest rates increasing leverage and a massive decline in inventory) most Americans have near record low equity in their homes:

And this should be no surprise since a large portion of the market is being driven by low down payment FHA insured loans:

The market is addicted to real estate debt. This is also an explanation as to why so few new homes are being built even though the market is signaling for more property (that is, affordable property). The underreported story of all of this is Americans have very little saved up at a time when tens of thousands are reaching retirement age. As the adage goes, you have to live somewhere. But you also have to eat and pay for those medical bills plus send your kids to college. Younger buyers are opting for these low down payment mortgages in droves because of lower incomes and also, higher debt burdens from giant levels of student loan debt.

People think that somehow, a wealthier state like California has the majority of people buying homes with all cash. While this may be true in areas like Beverly Hills or Atherton, most California homeowners are deep in debt on their home purchase.

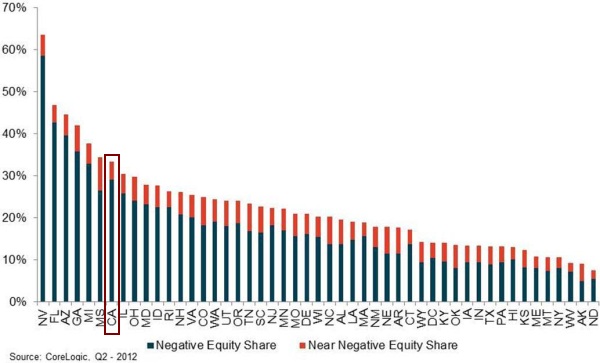

In California, only 22 percent of homeowners own their property free and clear (a much lower figure than the nationwide 30 percent figure). Not only is this the case, but a large number of Californians are underwater on their mortgages:

Roughly 30 percent of California homeowners are underwater and this figure goes up to 35 percent if we count those near negative equity. Equity in housing does count. And as the previous chart shows, equity in housing has been falling for a very long time. This is why those comments of ?and after 30 years, you will pay off your house!? That was true in previous generations. That is no longer the case. According to Census data and figures from the NAR, the typical homeowner stays put between 6 to 8 years. As many know, the first few years are heavily tilted to paying interest and less on principal. Throw in the 5 to 6 percent commissions for selling a home and a good portion of the equity can be wiped out unless you are in a market with perpetually higher home prices. We got a boost courtesy of the Fed with record low rates and QE but we are likely hitting a lower bound. Even if rates maintain the boost will run out of steam to match up with actual household incomes.

The current market is heavily dependent on real estate debt. The FHA now backs over $1 trillion in mortgage debt and is providing an obscene 30x leverage for many buyers. Then you wonder why they are in the red to the tune of $16 billion and are massively increasing mortgage insurance premiums.

We are starting to see the myth of ?well after 30 years you will own your home? and then these are the same people looking to hop on the property ladder once they rid themselves of their starter home in 7 years. As we pointed out, in hyper consumption states like California, very few actually own their home free and clear because of this mentality.

Keeping up with the Joneses

I have recently seen many people so blindly focused on one tiny aspect of their balance sheet diving into buying a home because they ran the numbers. In fact, one couple I know bought last year and on paper, everything looked good. Heavily discounted home compared to bubble price. Just a bit more than renting on a net-net basis. That is, until they started trying to keep up with their neighbors. First, they ?had? to buy a new car. After all, that 10 year old car looked like a clunker in a neighborhood with $40,000 to $60,000 SUVs. So add that as a new expense. These cars carry a much higher insurance premium. Add more to your monthly insurance. They also needed new furniture so there goes thousands of dollars. The spending is only beginning. They now need to update the kitchen and living room to match up with other hipsters. Clearly they have not worked with contractors in SoCal. The bill is going to jump up very quickly.

This is largely what happens. They also had to put their kids in a more expensive prep school. If all goes well, these kids might get accepted to a great college (if private, look at $50,000+ inflation adjusted to the future per year unless they are super star scholars). Then add to the mix that this will be the ?starter home? and they will look to move into a bigger (more expensive) home shortly. 5 to 6 percent will come off the top in that transaction.

So on paper, yes, it didn?t seem all that bad of a move to buy. Yet ancillary spending increased dramatically. Also, many younger people that buy are likely to lose one income for a period of time after a child is born if they plan on starting a family shortly after buying. If they go back to work, add in the cost of daycare. That is a sizeable hit to the bottom line.

And this is one of the items that people only focused on the numbers will miss. Consumer psychology and mass behavior. You have to examine both and this is part of behavioral economics but most can understand the common sense of this. This is why the home equity figures still look anemic above even in the face of rising home values. It is rather obvious that Americans are willing to go into massive debt to purchase (just look at FHA insured loans). The notion that everyone that is buying right now is going to stay put for 15 to 30 years flies in the face of the data. The idea that people will just buy and somehow not increase their spending to reflect that of their neighbors misses the core of our marketing driven nation. All you need to do is look at the hipster flippers and how they are tailoring their homes. This applies to many upper-income suburbs and cities. Keep in mind that with the typical US home costing $180,000 and median household income at $50,000 in raw numbers, most Americans can afford to buy (funny how that 3x annual income to mortgage ratio is coming back in line). Yet we are talking about households trying to purchase $600,000 homes with $100,000 incomes.

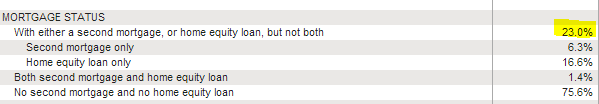

Some people get angry with flippers but remember someone on the other side has to close escrow on the place. In California, over 23 percent of mortgaged homes have either a second mortgage or a home equity loan:

Can you purchase in a prime neighborhood and not increase your spending? Of course. Yet the vast majority will not. You think all these people squeezing in with a 3.5 percent down payment have loads of cash? Of course not, otherwise they would go for a more conventional loan with better terms. It is interesting how the psychology of housing has shifted in the last generation. Today, we are still left with the mentality that housing is the road to riches asset class whereas in previous generations it was a place to live. You are even seeing this today where people are talking about how they perfectly timed the market. It reminds me of those people back in the high days of the bubble talking about the hundreds of thousands of dollars of equity they built up but never actually sold their home. Until you get that check when escrow closes, that money is just on paper. Many wanted the best of both worlds and simply tapped out the equity via more mortgage debt. Many can?t sell even today because they would ?have? to buy an equally high priced home in the same location. That is, if they didn?t tap out their equity. There is one certainty about our economy and that is, we as a nation have very little fear of going into massive consumption debt.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble?s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble?s Blog to get updated housing commentary, analysis, and information.

(7 votes)

Source: http://www.zerohedge.com/contributed/2012-12-14/housing-debt-we-trust

david wright cory booker cubs cj wilson ellsbury brad pitt and angelina jolie brad and angelina

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.